AI Is Challenging Seat-Based Pricing

Seat-based pricing is in decline. SaaS companies that don’t adapt will follow.

The numbers tell the story. Seat-based pricing adoption dropped from 21% to 15% in just 12 months. Hybrid pricing models jumped from 27% to 41% in the same period. Companies sticking with seat-only models now experience 2.3× higher churn.

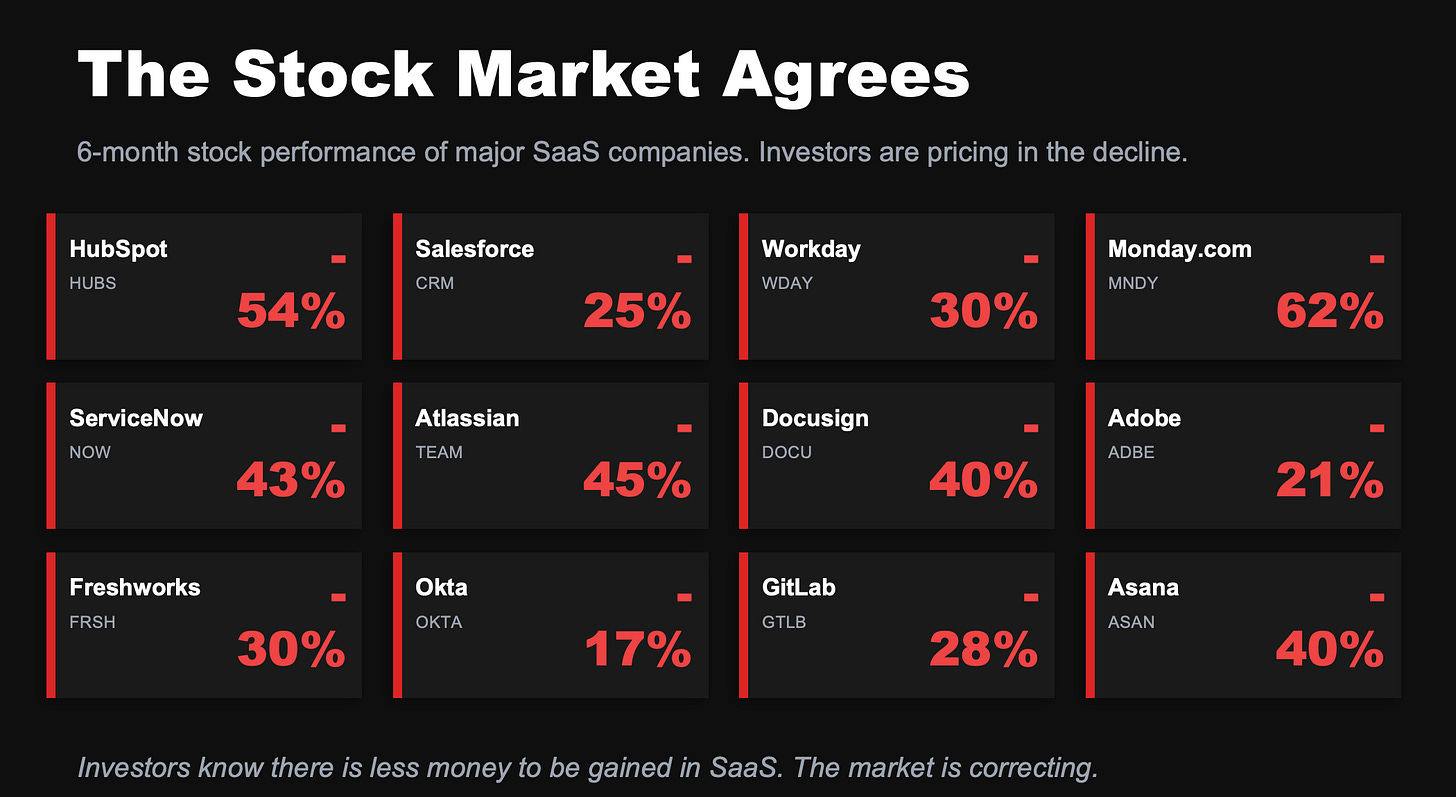

The market sees it too. HubSpot is down 54% over six months. Monday.com dropped 62%. ServiceNow fell 43%. Investors are pricing in the decline because they understand what’s happening.

The AI Efficiency Trap

Every SaaS vendor promises the same thing: “Make your team more efficient with AI.”

Even if half these claims are exaggerated, the result is the same. Companies need fewer people to do the same work. And the market isn’t growing fast enough to compensate.

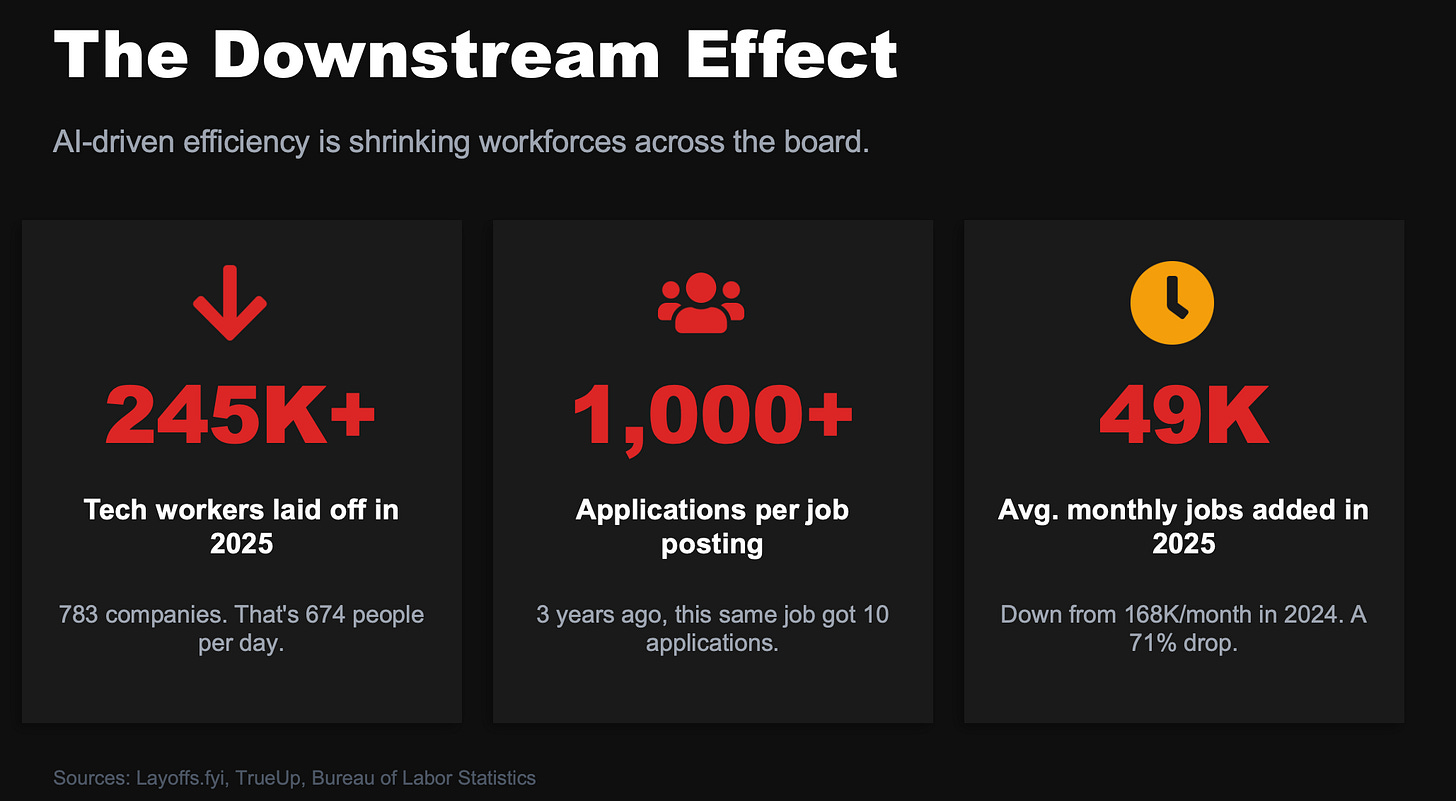

The data backs this up. Tech companies laid off 245,000 workers in 2025 across 783 companies. That’s 674 people per day. Job postings that received 10 applications three years ago now get over 1,000. Monthly tech job additions dropped from 168,000 in 2024 to 49,000 in 2025—a 71% decline.

The Churn Cascade

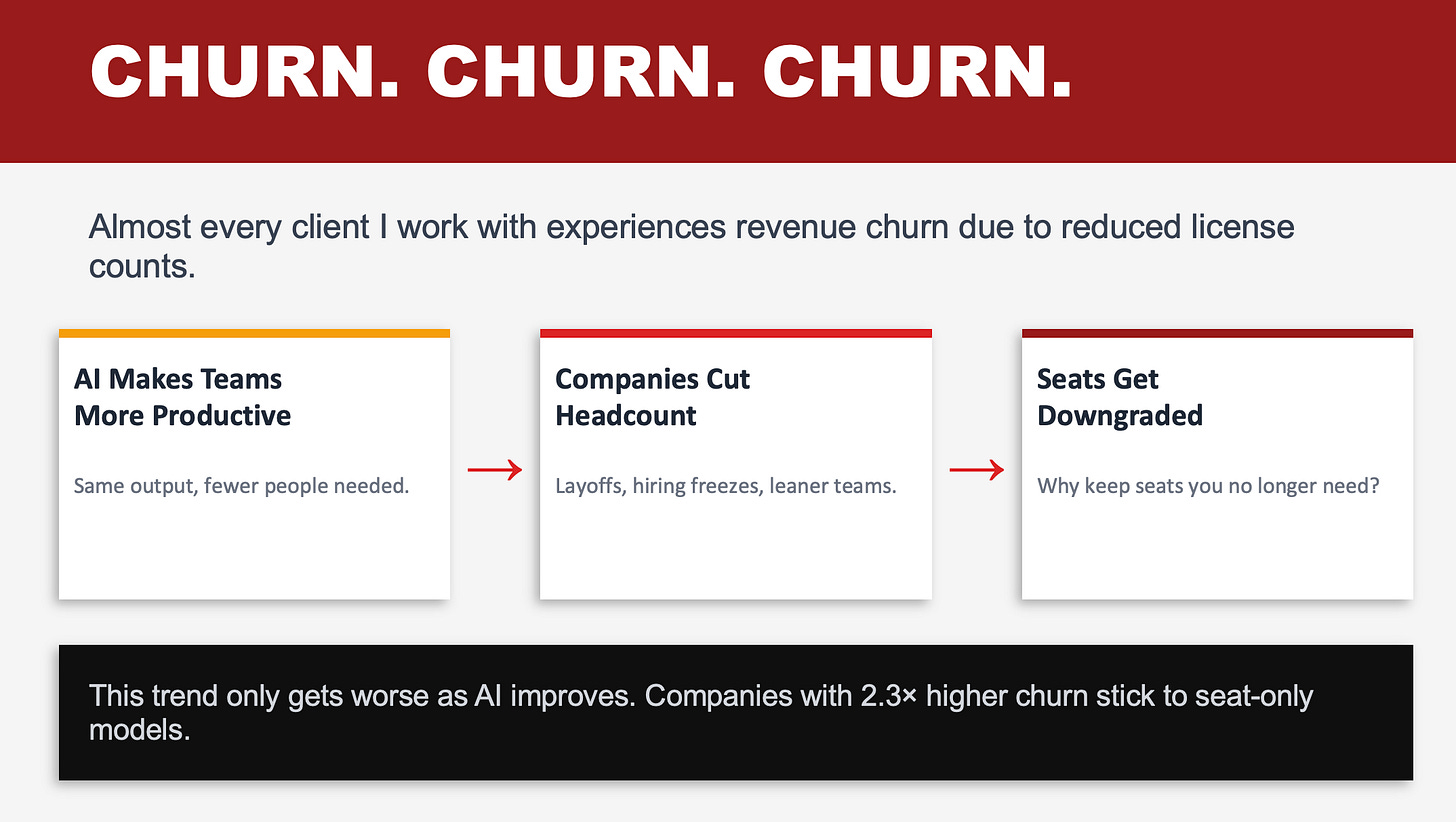

Here’s what happens: AI makes teams more productive. Companies cut headcount. Seats get downgraded.

Why would a company keep 50 seats when 30 people can now do the same work?

This isn’t speculation. Almost every client I work with reports revenue churn from reduced license counts. The trend accelerates as AI improves. Your annual contracts don’t matter when customers are paying for seats they don’t need.

What To Do About It

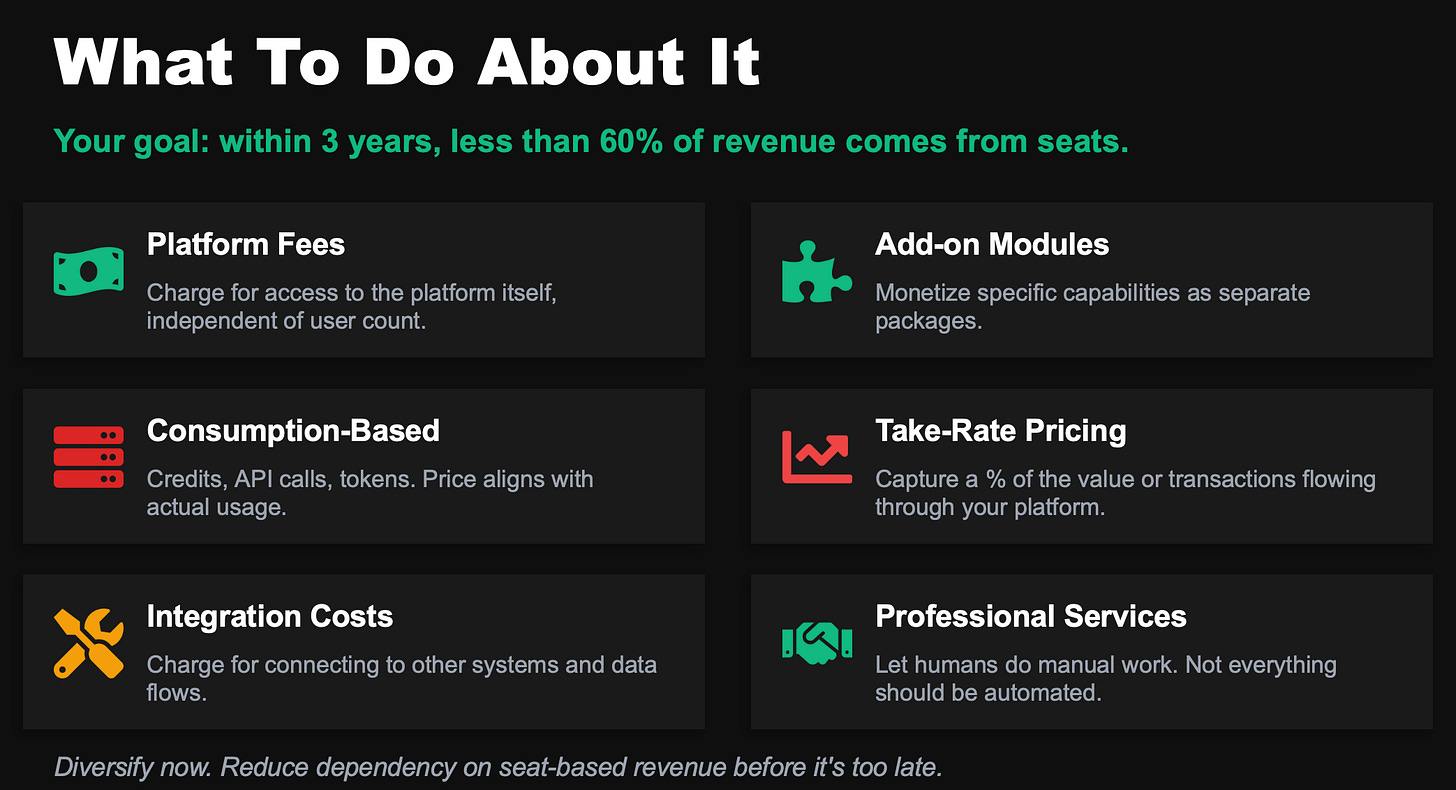

Your target: within three years, less than 60% of your revenue should come from seats.

Six pricing models can replace seat dependency:

Platform fees: Charge for access to the platform itself, independent of user count.

Add-on modules: Monetize specific capabilities as separate packages.

Consumption-based: Credits, API calls, tokens. Price aligns with actual usage.

Take-rate pricing: Capture a percentage of value or transactions flowing through your platform.

Integration costs: Charge for connecting to other systems and data flows.

Professional services: Let humans do manual work. Not everything needs automation.

Sixty-five percent of SaaS vendors now layer AI metrics on top of seat pricing. Companies that stick with seat-only pricing see 40% lower gross margins for AI products.

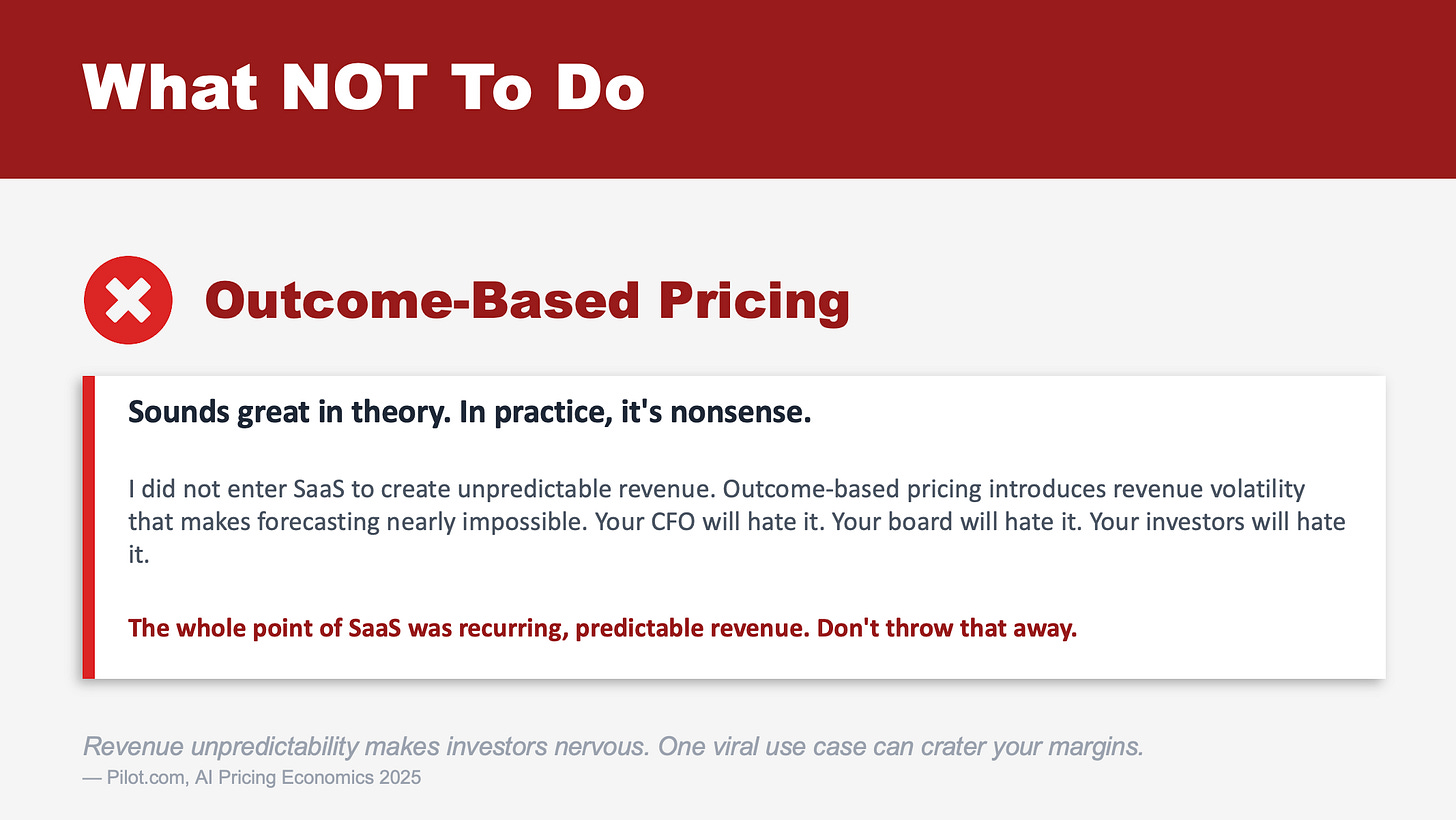

What NOT To Do

Outcome-based pricing sounds appealing, but does it work?

Revenue unpredictability makes investors nervous. Your CFO will dismiss it. Your board will hate it.

The whole point of SaaS was recurring, predictable revenue. Don’t throw that away chasing a pricing model that introduces volatility you can’t control.

Beyond that, many business models are not suitable for outcome-based pricing.

The Timeline

You have five years. Change is slow.

Year 1-2: Introduce hybrid pricing models.

Year 3: Target less than 60% revenue from seats.

Year 5: Full pricing diversification.

That’s good news. You have time. But ignoring this risk means you probably won’t survive the next five years.

Your Next Steps

Your GTM leadership team needs to meet with product to determine which changes enable your survival.

First, audit your revenue mix. How much depends on seat count today?

Second, identify 2-3 alternative pricing levers you can introduce within 12 months.

Third, align GTM and Product on the transition roadmap.

The clock is ticking. The market won’t wait for you to figure this out.