Expanding to Europe? Here’s Why Your U.S. Strategy Won’t Work

Expanding into Europe requires rethinking your U.S. GTM strategy. Europe isn’t a unified market; it’s a mosaic of diverse languages, cultures, regulations, and consumer behaviors.

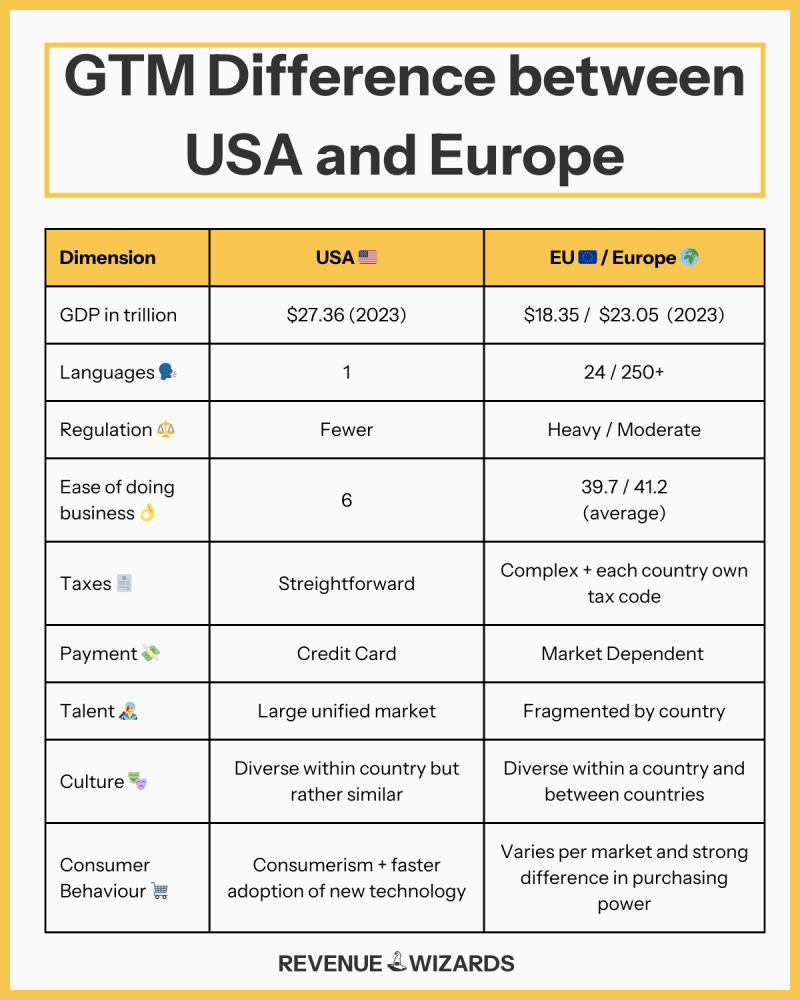

Expanding your business globally? Start by recognizing that the U.S. and Europe are vastly different when it comes to go-to-market (GTM) strategies. While the United States operates as a single, relatively uniform market, Europe is a mosaic of distinct countries, cultures, and regulations. These differences directly impact how businesses approach everything from scaling operations to consumer engagement. Here’s a closer look at the key dimensions highlighted in the comparison chart and why each of them matters.

1. Economic Scale: GDP

The United States boasts a GDP of $27.36 trillion (2023), reflecting a massive, unified market. By contrast, the European Union (EU) stands at $18.35 trillion, with the broader continent totaling $23.05 trillion.

For businesses targeting Europe, understanding the fragmented economic landscape is essential. While Germany, France, and the UK may provide opportunities similar to the U.S., smaller markets like Portugal or Slovenia have significantly different scales and growth trajectories.

2. Languages: Communication Barriers

One of the most visible differences lies in language diversity. The U.S. operates almost entirely in English, providing simplicity in communication and marketing. Europe, on the other hand, has 24 official EU languages and over 250 spoken languages across the continent.

This linguistic diversity means that businesses cannot rely on a one-size-fits-all approach. For instance:

Marketing content must be localized, not just translated.

Sales teams need proficiency in the local language, especially in B2B or non-tech industries.

Customer support may need to be available in multiple languages, depending on your target markets.

To overcome this, many companies establish regional hubs and hire local talent to ensure language and cultural fluency.

3. Regulation: A Heavily Governed Landscape

The U.S. regulatory environment is relatively straightforward compared to Europe’s. In the EU, businesses must navigate complex regulatory frameworks at both the national and EU levels. While the EU provides some harmonization through its single market policies, individual countries still enforce unique laws in areas like taxation, employment, and consumer protection.

However, there’s an upside: achieving compliance in one EU country often makes it easier to expand to others. For example, adhering to the EU’s GDPR (General Data Protection Regulation) opens the door to data handling in multiple member states. Still, the sheer volume of red tape can slow down decision-making and execution.

4. Ease of Doing Business

The World Bank’s "Ease of Doing Business" ranking highlights the significant differences between the U.S. and Europe. The U.S. ranks 6th globally, benefiting from streamlined processes, consistent regulations, and an entrepreneur-friendly environment. Europe’s average ranking, however, sits at 39.7, with considerable variation among countries. (e.g. Denmark is 4th above the US)

What does this mean for businesses?

In the U.S., scaling often requires fewer adjustments to processes.

In Europe, bureaucracy varies. Some markets, like Denmark or the Netherlands, are relatively easy to operate in, while others, such as Italy or Greece, present more obstacles.

A business entering Europe must assess the operational landscape of each target country to plan accordingly.

5. Taxes: A Complex Challenge in Europe

In the U.S., taxes are relatively straightforward, with businesses dealing mainly with federal, state, and local tax codes. In Europe, every country has its own tax system, VAT rates, and compliance requirements.

For example:

VAT (Value Added Tax) rates differ across the EU, and businesses must register for VAT in each country where they sell goods or services.

Corporate tax rates and rules around profit repatriation vary widely.

This complexity increases the cost of compliance and requires robust tax expertise or partnerships with local firms.

6. Payment Systems: Credit Card vs. Market-Specific Preferences

In the U.S., credit cards dominate payment systems, creating consistency and ease for consumers and businesses. In Europe, payment preferences are market-dependent.

Examples include:

In Germany, direct bank transfers and invoicing are more common than credit cards.

In Sweden, digital wallets like Swish dominate.

Across many European countries, cash remains a preferred method for smaller transactions.

Businesses must adapt their payment systems to align with local consumer habits. Implementing region-specific solutions, such as SEPA for bank transfers or Klarna for buy-now-pay-later, can significantly improve conversion rates.

7. Talent Availability: Unified vs. Fragmented Labor Markets

The U.S. benefits from a large, unified labor market. Talent moves freely across states without language barriers or legal restrictions. Europe’s labor market, however, is fragmented by language, culture, and varying labor laws.

Key challenges in Europe:

Labor mobility is restricted by linguistic and cultural factors.

Labor laws vary widely, influencing hiring costs and flexibility.

Specialist talent, such as in tech, may be concentrated in specific hubs like Berlin or Amsterdam.

To navigate this, businesses often establish multiple regional offices and invest heavily in recruitment tailored to local markets.

8. Cultural Diversity: Nuances Across Countries

While the U.S. has cultural diversity within a shared framework, Europe’s diversity is more pronounced both within and between countries. For example:

A marketing strategy that resonates in the UK might fall flat in Spain or Poland.

Attitudes toward consumerism, sustainability, and digital adoption differ widely across markets.

Understanding these cultural nuances is critical to tailoring everything from branding to customer engagement. Businesses must invest in market research to avoid cultural missteps that could harm their reputation.

9. Consumer Behavior: Adoption Patterns and Purchasing Power

In the U.S., consumerism drives rapid adoption of new technologies and products, supported by relatively high disposable incomes. Europe, on the other hand, presents a patchwork of consumer behaviors:

In wealthier markets like Germany or Scandinavia, consumers may embrace innovation but are often more cautious than Americans.

In Southern and Eastern Europe, purchasing power is lower, and price sensitivity is higher.

These differences require tailored go-to-market approaches, from pricing strategies to product positioning.

GTM Strategy Recommendations

Start with Early Adopters: Early adopters exist across Europe, but they are only an entry point. A sustainable business model requires scaling to broader segments.

Enter the UK First: The UK offers a market similar to the U.S., with English as the primary language. Use this as a stepping stone to enter other European countries.

Commit to a Single Market: Focus on one country (e.g., Germany or France) and invest in local assets, such as native-speaking sales teams and tailored campaigns.

Adapt to Local Culture: Walmart’s failure in Germany compared to Aldi’s success in the U.S. demonstrates the need to respect local buying behaviors.

Base in a Tech Hub: Cities like London, Berlin, or Amsterdam are ideal for accessing talent and building infrastructure.

Final Takeaway

Europe’s complexity is both a challenge and an opportunity. Success requires treating each country as a unique market while leveraging the EU’s harmonized regulations to scale efficiently. Many European startups prioritize entering the U.S. first due to its simplicity, but U.S. companies eyeing Europe must embrace the nuances or risk costly missteps. Adapt to these realities, and you’ll unlock one of the world’s most lucrative and diverse regions for growth.