Is RevOps Shrinking? Uncovering the Global Trends and Future of Revenue Operations

Comparing 2023 and 2024 LinkedIn data

People who know me will tell you how passionate I am about RevOps. So, you can imagine my shock when I looked at the data and noticed that the global RevOps population had decreased by 1,000 people.

WHAT IS HAPPENING TO MY PROFESSION?

Why is it shrinking?

During university, my favorite subjects were research, statistics, and analyzing large data sets for my economics thesis. So, as you can imagine, this data digging is fun for me.

Now that we understand the global disruption, what about specific regions?

It turns out the decline was driven by North America, while other regions were actually seeing growth. Particularly, the EMEA region is experiencing an increase in RevOps professionals. Since I’m based in Amsterdam, I can confirm this with anecdotal evidence—more companies are hiring for RevOps, teams are growing, and the job market is positive. Jack Hargett, a RevOps recruiter from London, explained it this way:

He made a great point. People are doing RevOps but may not necessarily have "RevOps" in their title.

RevOps is both a department and a strategic framework. You can follow the principles of RevOps without having it in your title. For instance, before my role was officially called RevOps, I worked in Sales Operations. At some point, I realized that what I was doing—supporting sales, marketing, and customer success—was essentially RevOps. Convincing the leadership team to change the title took time, but it was a necessary step. Many companies are in a similar position.

However, I would strongly advocate for calling it RevOps because semantics matter. It's simply clearer to call it "Revenue Operations."

So, it's possible there are people working in RevOps under different titles. If that's the case, the numbers in EMEA should be even higher. But does this fully explain the decline in RevOps?

Before writing this blog, I shared the data on LinkedIn without much explanation to see how the RevOps community would interpret it. One recurring point was the number of GTM titles.

Mallory, that was a great point! I hadn’t considered that, so I checked for the strings “GTM Operations” and “GTM Ops.” Those two titles account for about 780 professionals. The limitation is that I didn't measure this a year ago, so I have no easy comparison. Stay tuned for next year's comparison!

Even so, that still wouldn’t fully account for the gap, assuming all of those with GTM Ops titles are from the past 12 months.

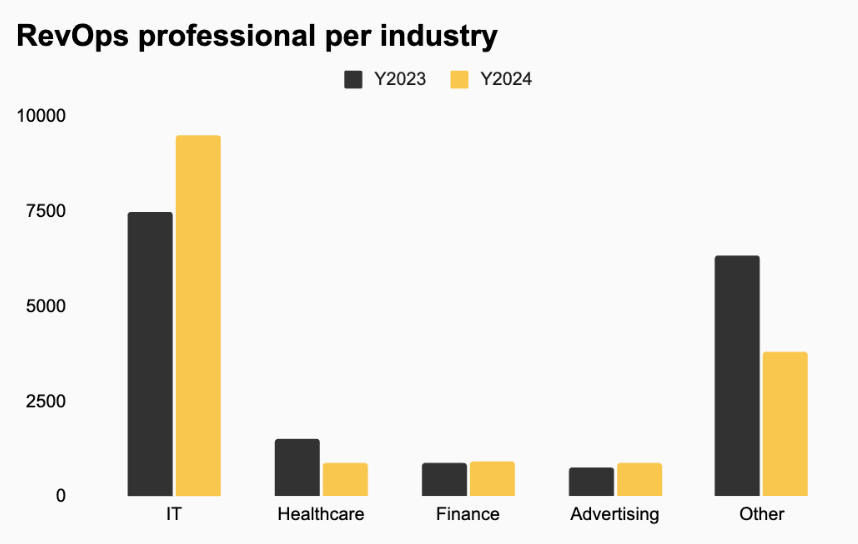

Could industry differences explain the decline?

This is where it gets interesting. We’ve seen a significant increase in the IT sector, which includes both software and hardware-related businesses, with smaller increases in finance and advertising.

Let’s break this down. RevOps focuses on revenue, and several parts of a business impact revenue: sales, marketing, and customer success. This is especially important for businesses with recurring revenue models, such as SaaS, finance (loans or mortgages), or advertising (where clients are often managed on a retainer model). However, RevOps principles are still applicable to other industries, like furniture sales, where aligning marketing and sales around revenue is crucial. Some companies may already be doing this but just call it "Sales Operations."

Side topic: I am working on a RevOps book. For that I want to hear from you! I am conducting a global RevOps survey. Part of results of the survey will be used in the book. Making it a community driven book for the RevOps community. Want to participate? Follow the this link.

It only takes 7-12 min and for each response we will donate to animal charity.

One practical explanation for the data shift could be that some industries previously classified under "Other" have moved into the IT category. I can’t rule that out.

Now, let’s compare company sizes.

We see no noticeable change for companies with fewer than 500 employees, a slight increase for those between 501 and 1,000 employees, a slightly larger decrease for companies with 1,001 to 5,000 employees, and a significant drop for enterprises with more than 5,000 employees.

So, what’s happening here?

We’ve heard about widespread layoffs over the past 24 months. It’s likely these layoffs have affected the data. Large enterprises, which typically have more cash and tend to solve problems by hiring more people, became inefficient. The layoffs were a correction, and now there simply aren’t enough RevOps jobs in large enterprises.

Interestingly, other company sizes haven’t been as impacted. It might be easier to find a new RevOps role in a startup compared to a large enterprise. There’s always another scaling startup around the corner that needs talented RevOps professionals.

Another factor in large enterprises is the need for specialization. A person with a RevOps title may focus more on strategy, while execution roles (like enablement specialists, solution architects, or system administrators) might not carry the RevOps title but still fall under the RevOps umbrella.

This could include roles like:

Enablement specialists

Solution architects

System administrators (focused on permissions, flows, etc.)

Project managers

Database managers

Pricing specialists

The organizational chart below helps illustrate this.

Could RevOps be saturated in enterprises?

Take the table below, based on LinkedIn data. There are over 24 million companies with 1-50 employees, but only 6,000 companies with more than 5,000 employees. It makes sense—it's easier to start a business than to grow one to enterprise size.

While larger enterprises have the highest share of RevOps professionals, it’s important to interpret these numbers with caution. For instance, 100 RevOps professionals in one large enterprise and 100 spread across 100 small companies would yield the same percentage.

Still, we can conclude that larger enterprises have relatively more RevOps professionals than smaller companies.

Putting it all together

To summarize:

The global RevOps population is down by 1,000 people.

GTM Ops titles only explain a fraction of the decline.

The largest drop occurred in North America.

RevOps professionals in the IT sector increased, while other industries saw declines.

Large enterprises experienced the biggest drop in RevOps professionals.

Hypothesis 1: Layoffs hit North America’s RevOps professionals the hardest.

It’s possible that layoffs had such a strong impact in North America that, despite growth in the IT sector, the overall number of RevOps professionals declined.

Hypothesis 2: RevOps in non-recurring revenue industries became more specialized (again).

RevOps is most effective in businesses with recurring revenue models. Non-recurring revenue industries may have experimented with RevOps, but during tough times, these professionals were laid off.

While both hypotheses offer potential explanations, I don’t have the data to confirm either one. If you know a PhD student looking for a research topic, share this blog—it could be an interesting area to explore.

The Future of RevOps

Is RevOps doomed? I doubt it. While the golden age of SaaS (2009-2021) might be over, we’re nearing the end of the correction (layoffs tend to have a lagging effect). Right now, there’s a spike in demand for RevOps, especially in the EMEA region, with North America catching up.

I’m optimistic about the future and look forward to revisiting this assessment in 2025.

Revenue Wizards is a hands-on Revenue Operations Consultancy for growth companies focusing on efficiencies. We provide GTM & RevOps support with the goal of Revenue growth, GTM cost reduction, and Profitability. You can learn more about Revenue Wizards here.

Zhenya Bankouski is Co-Founder and Revenue Operations Partner. You can follow him on LinkedIn 🔔 where he posts regularly with practical advice on building efficient RevOps teams and truly data-driven organizations.

Haris Odobasic is Co-founder and Revenue Strategy Partner. Enjoys bringing strategy to life with RevOps.